Score Big on Black Friday: Discover Proven Credit Repair Methods to Improve Your Finances

Black Friday, the notorious day after Thanksgiving, has become synonymous with incredible shopping deals and discounts. It has evolved into a shopping extravaganza, where eager consumers flock to stores and websites to snag the best bargains. But did you know that Black Friday can also be an opportunity to improve your credit score and find credit relief?

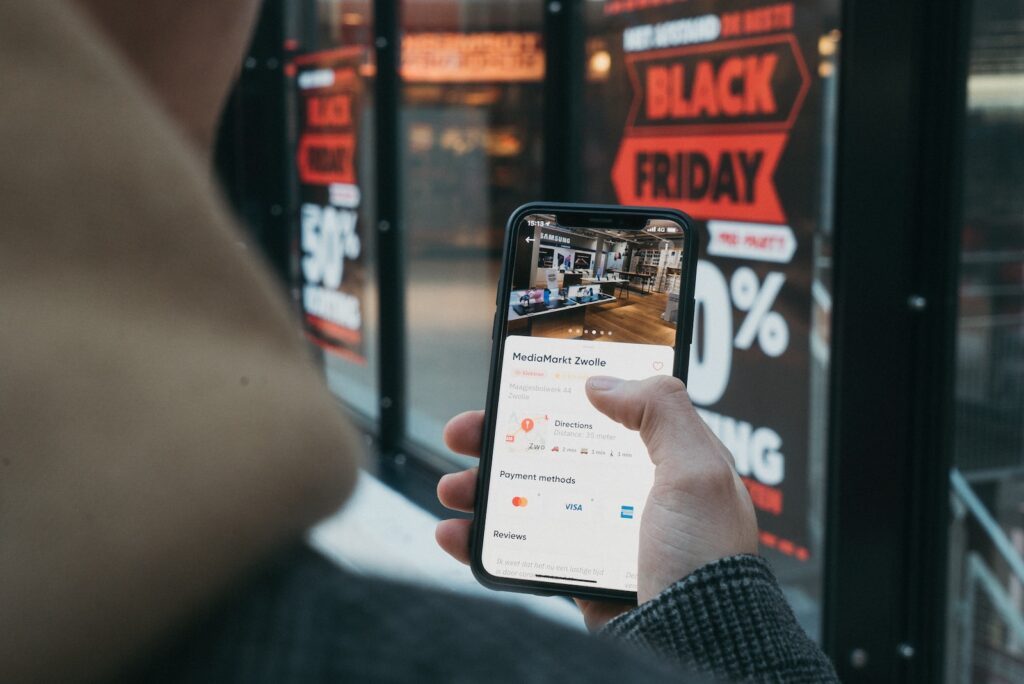

Photo by CardMapr.nl on Unsplash

Many retailers offer special financing options and credit card deals during this time, allowing consumers to take advantage of lower interest rates and flexible payment plans. By making smart purchasing decisions and paying off your credit card balance on time, you can not only save money on your Black Friday purchases but also boost your credit score in the process. So, as you prepare your shopping list and get ready to score those amazing Black Friday deals, keep in mind the potential benefits for your credit score and financial well-being.

The relevance of Black Friday for improving finances through credit repair methods

Black Friday, the day after Thanksgiving, is not only known for its incredible deals and discounts on consumer goods, but it can also be a golden opportunity for individuals looking to improve their credit scores and find some much-needed credit relief. With the right strategies and mindful spending, this shopping extravaganza can become a stepping stone towards financial stability. Many retailers offer special promotions and discounts exclusively for Black Friday, allowing consumers to purchase essential items at lower prices.

By taking advantage of these deals, individuals can save money and allocate those savings towards paying off debts or making on-time credit card payments. Additionally, using a credit card responsibly during Black Friday can help establish a positive payment history, ultimately improving one’s credit score. Therefore, it is crucial to approach Black Friday with a clear plan, focusing on credit score improvement and utilizing the available discounts and promotions to achieve long-term financial goals.

Understanding the Importance of Credit Repair

The significance of a good credit score in financial stability and opportunities

Having a good credit score is of utmost importance when it comes to financial stability and seizing opportunities. A high credit score opens doors to better interest rates on loans, mortgages, and credit cards. It signifies that you are a responsible borrower and are likely to repay your debts on time.

With a good credit score, you have the advantage of accessing credit relief options during times of financial hardship. Moreover, a solid credit score can enhance your chances of securing employment or renting a home. As Black Friday deals roll around, having a good credit score can make a significant difference in your ability to take advantage of the best discounts and offers. So, it’s crucial to actively work on improving your credit score by making timely payments, keeping your credit utilization ratio low, and monitoring your credit report regularly.

How credit repair can help improve credit scores and overall financial health

Credit repair can play a crucial role in improving credit scores and overall financial health. By addressing negative items on your credit report, such as late payments, collections, or charge-offs, you can significantly boost your creditworthiness. This process involves scrutinizing your credit history, identifying errors or inaccuracies, and disputing them with the credit bureaus. Additionally, credit repair companies can negotiate with creditors to remove negative marks or settle debts for a reduced amount.

As a result, your credit score can increase, making you more eligible for favorable lending terms and lower interest rates. With the holiday season fast approaching, taking advantage of Black Friday deals may seem tempting. However, without a healthy credit score, obtaining credit or loans for these bargain purchases may prove challenging. Therefore, considering credit repair as a means to improve your financial standing can provide much-needed relief and pave the way for a brighter financial future.

Exploring Black Friday Deals for Credit Repair

The availability of discounted credit repair services and products on Black Friday

Black Friday, the much-awaited shopping extravaganza, is just around the corner, and it’s not just limited to electronics and fashion deals. This year, consumers can also take advantage of the incredible discounts on credit repair services and products. If you’ve been struggling with a less-than-stellar credit score, now is the perfect time to jump on the bandwagon and give it a much-needed boost.

With a plethora of credit relief options available, ranging from affordable credit repair services to discounted credit monitoring subscriptions, you can finally take control of your financial future. Don’t miss out on this golden opportunity to improve your credit score and pave the way towards a brighter financial future. So mark your calendars and get ready to snag those amazing Black Friday deals that could potentially transform your credit situation.

The various credit repair deals and promotions that consumers can take advantage of

Consumers looking to improve their credit score can take advantage of a variety of credit repair deals and promotions, especially during the Black Friday shopping season. With many companies offering special discounts and incentives, now is the perfect time to explore options for credit relief. Whether it’s discounts on credit monitoring services or reduced fees for credit counseling sessions, there are plenty of opportunities for individuals to make a positive impact on their creditworthiness.

Additionally, some credit repair companies may even offer exclusive deals on credit report disputes or debt negotiation services. By taking advantage of these promotions, consumers can not only save money but also take important steps towards rebuilding their credit. It’s important, however, to carefully research and compare different offers before making a decision. With the right approach, individuals can find the most effective credit repair deals that align with their specific needs and financial goals.

Examples of credit repair services and products to look out for on Black Friday

Black Friday is just around the corner, and if you’re looking to improve your credit score, now might be the perfect time to take advantage of some great deals and offers. Many credit repair services and products will be available at discounted prices, allowing you to get the help you need without breaking the bank. From credit monitoring services that keep a close eye on your credit report to credit counseling sessions that provide expert advice on managing your finances, there are plenty of options to choose from.

Additionally, you may come across special promotions on credit repair software, which can help you track your progress and dispute any errors on your credit report. Don’t forget to keep an eye out for any credit relief programs that may be available during the Black Friday sales. These programs can provide much-needed assistance in reducing your debt and improving your credit score. So, make sure to do your research and stay tuned for the best credit repair deals this Black Friday!

Proven Credit Repair Methods for Long-Term Improvement

The importance of addressing the root causes of credit issues for lasting credit repair

Credit score improvement is a topic that is of great concern to many individuals, especially during the holiday season. With Black Friday deals and other tempting offers, it can be easy to fall into the trap of overspending and accumulating debt. However, it is crucial to understand that addressing the root causes of credit issues is essential for lasting credit repair. Simply relying on quick fixes or temporary credit relief measures may provide temporary relief, but they will not solve the underlying problems.

To truly improve one’s credit score and financial standing, it is important to take a comprehensive approach. This involves analyzing spending habits, creating a realistic budget, and developing responsible financial habits. By addressing the root causes of credit issues, individuals can pave the way for long-term credit repair and financial stability. So, this holiday season, let’s prioritize lasting credit improvement instead of succumbing to the allure of short-term deals.

Effective credit repair methods such as reviewing credit reports, disputing errors, and managing debts

Are you looking to improve your credit score? Well, you’re in luck because Black Friday is just around the corner and it’s the perfect time to take advantage of some amazing deals on credit repair methods. One of the most effective ways to boost your credit score is by reviewing your credit reports for any errors or inaccuracies. By disputing these errors with the credit bureaus, you can potentially have them removed from your report, which can have a positive impact on your score.

Additionally, managing your debts responsibly is crucial for credit relief. Creating a budget, paying your bills on time, and keeping your credit utilization low are all strategies that can help improve your creditworthiness. So, don’t miss out on the opportunity to grab some incredible deals this Black Friday and start your journey towards better credit today!

- Think Your Credit Dispute Is Over? Think Again

- Tired of Bad Credit? Discover the Power of DIY Repair!

- Complete Guide to Credit Repair Services: Boost Your Credit Score with Confidence

- Backdoor Methods for Credit Repair: Unlocking Hidden Opportunities for Credit Success

- Repossession Blues: The Lowdown on Fighting It on Your Credit Report!